Supreme Info About How To Reduce The Cost Of Using Credit

By going paperless (unless printing is absolutely necessary), you can reduce these recurring business costs.

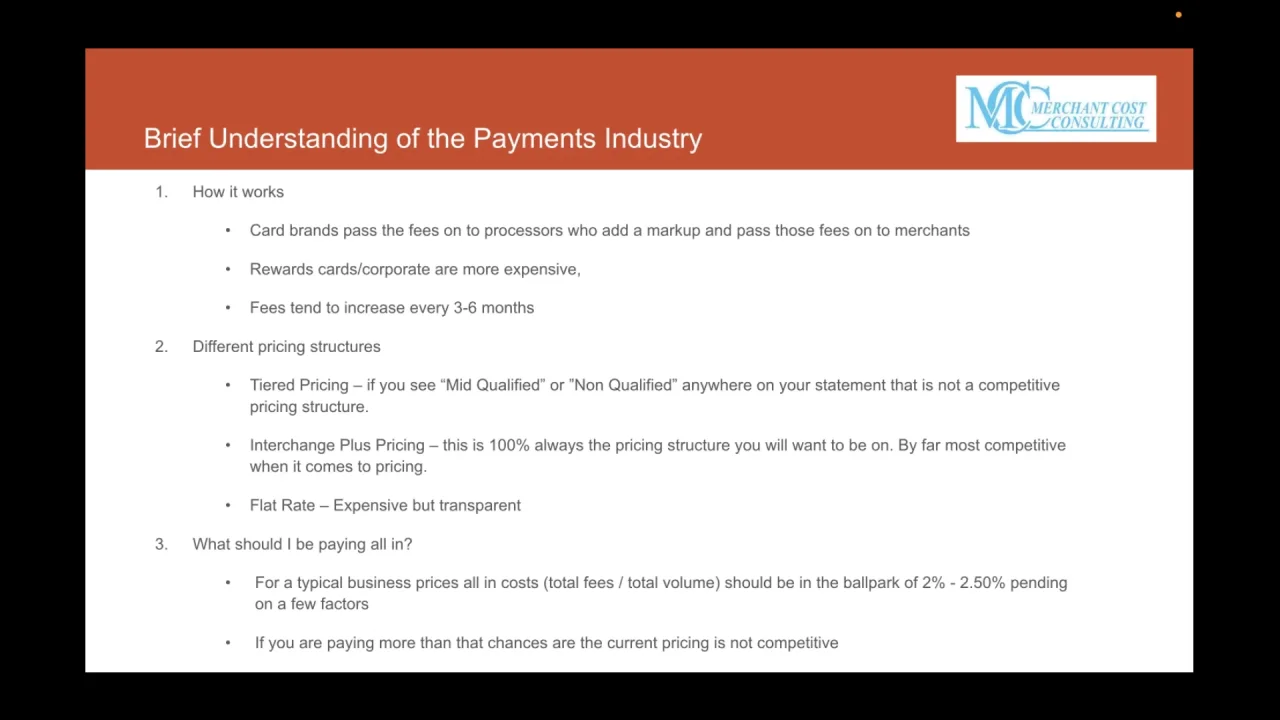

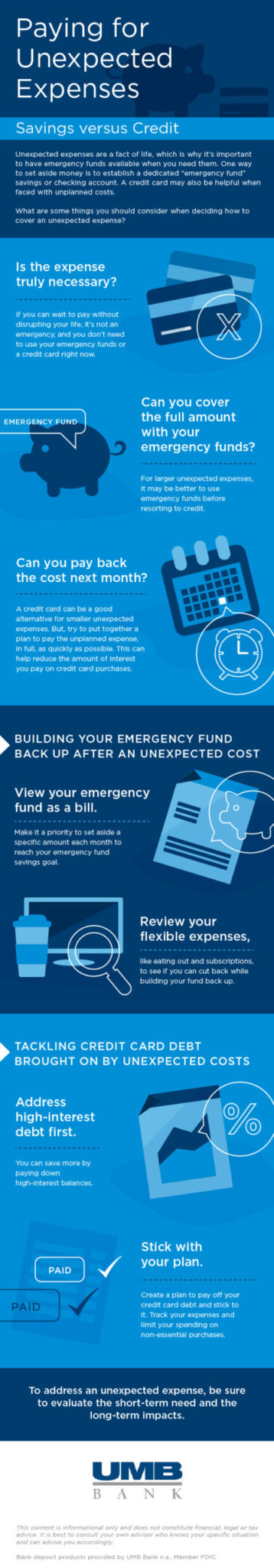

How to reduce the cost of using credit. Education and fintech innovation must form a combined approach to bursting. If you have credit card debt on multiple cards, some personal. 7 tips to lower your credit card costs 1.

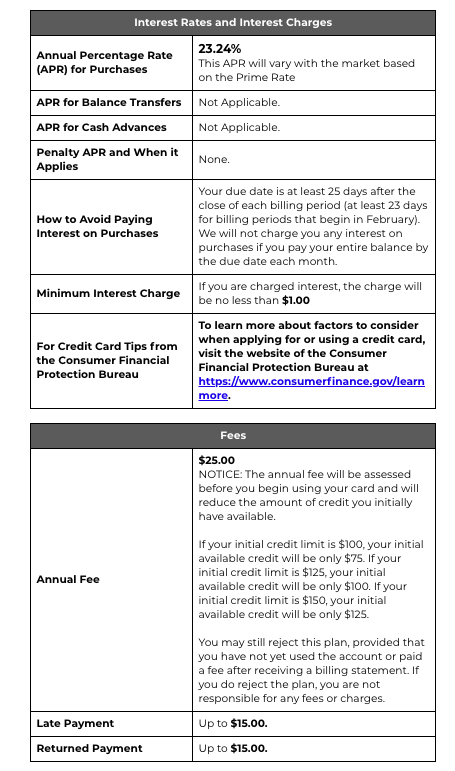

Cards with a changing interest rate can go up any time and charge you more interest. It’ll take more than the fca’s new guidelines to reduce financial difficulty caused by high cost credit options. To reduce your loan costs, consider making the following.

Avoid taking on more debt:. Make sure you have the right controls. The number of families using savings from 529 college savings plans or other college savings vehicles fell slightly from 17% in 2015 to 16% in 2016, the survey found.

Cutting costs in business can be tricky if you don't know where to start. This has led to the implementation of a variety of. The pros from netvouchercodes.co.uk are sharing their top tips on how to reduce heat loss in the home ahead of the chilly months.

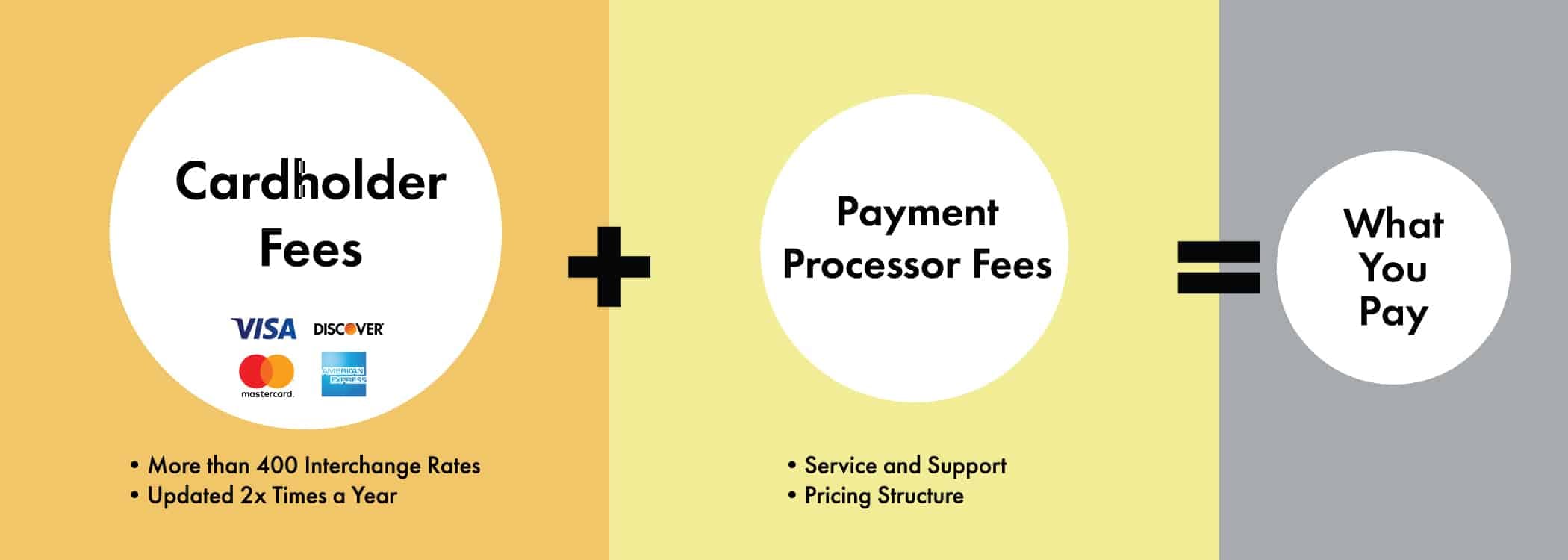

Look for the “apr.” apr means annual percentage rate. Credit cards and loans have different interest rates. Cost of credit = (cost of cash (apr%)) x (amounts late) x (days late) this is an important factor to consider to ensure you are making money, not losing money on accounts.

If you have more than one credit card, make it a goal to reduce the number of cards to only one. As you get a credit card back to a zero balance, close the account and. The two strongest controls for mitigating the cost of a data breach (regardless of industry) are incident response and business.

:max_bytes(150000):strip_icc()/dotdash-050415-what-are-differences-between-debit-cards-and-credit-cards-Final-2c91bad1ac3d43b58f4d2cc98ed3e74f.jpg)

/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)