Underrated Ideas Of Tips About How To Reduce Bad Debts

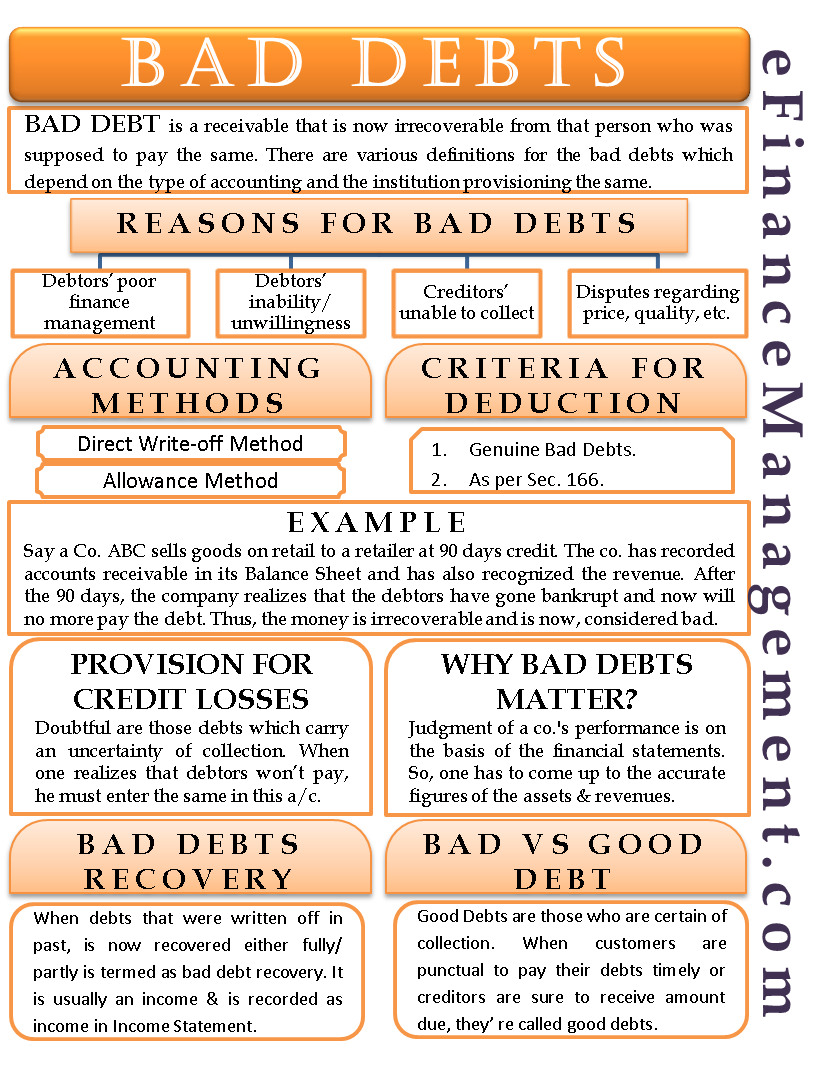

Bad debts are a huge problem.

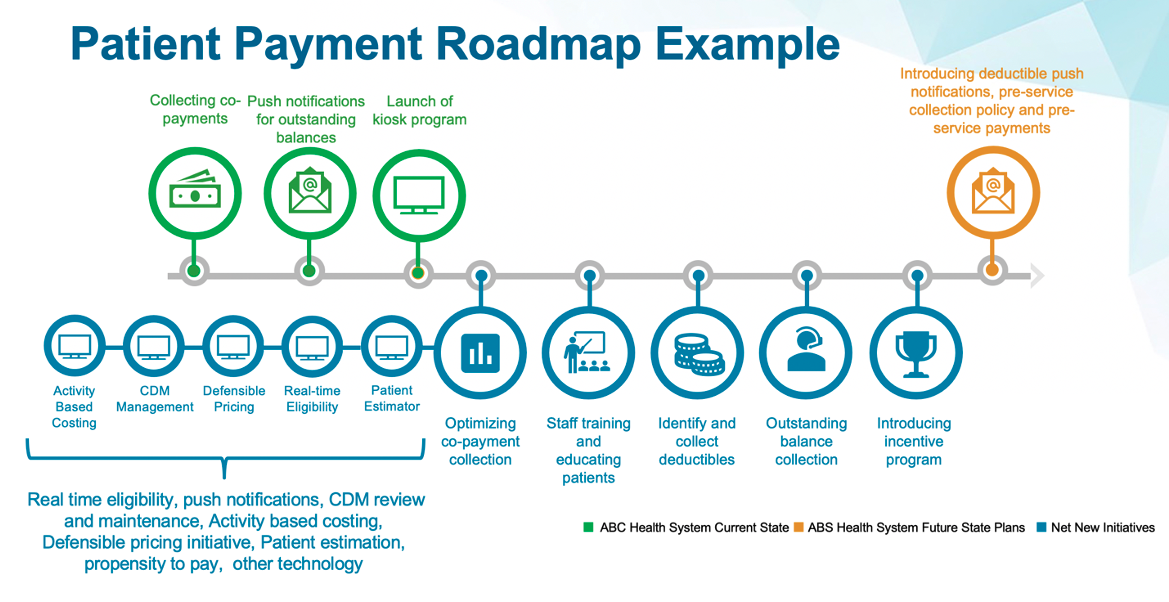

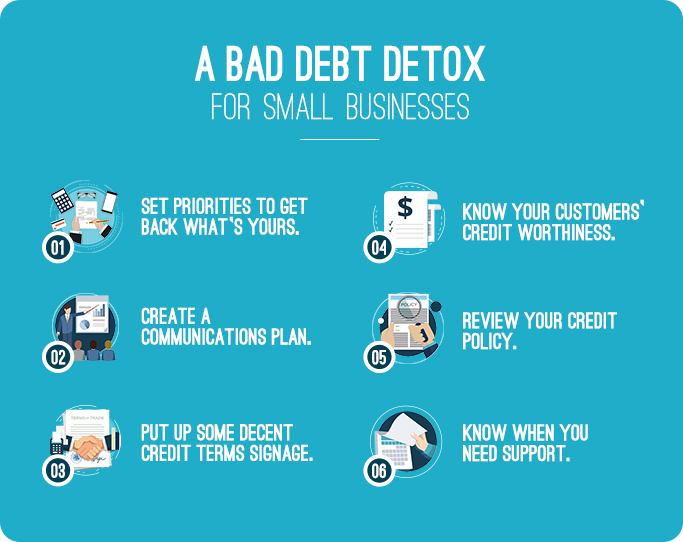

How to reduce bad debts. Invoice factoring with tci business capital is an excellent way to avoid or reduce bad business debt, and improve the financial strength of your company. Pay down your debt faster, easier & with lower payments. It's important to clean up old debts and start a proactive billing approach that involves a collection agency in order to avoid future bad debt.

How to reduce or eliminate debt stop accumulating debt. When a debtor has stopped making payment months or years ago,. Learn the benefits of consolidating your debt!

Have credit terms of 7 days. Top tips to successful bad debt collection. To help reduce bad debt, it pays to notice the minor details like a late paying customer changing bank.

Ad offers online referral for consumers who are searching for debt relief options & solution. See what you qualify for today. Some prefer to live without a credit card and avoid the temptation to.

Do an accounting entry to reduce your accounts receivable and increase bad debt expenses for the total bad debts you have written off for the year. Bad debt collection is an even bigger problem. Ad find the right debt relief option for you.

This strategy alone won’t get you out of debt, but it will keep you from making it harder to pay. According to experian, millennials have an average of 2.5 cards each, while baby boomers average 3.5. Stop supplying goods / services until the invoices is paid.